r&d tax credit calculation uk

Claim Capital is the fastest growing Innovation Funding Specialist in the UK 290 client growth in 2020 which has built a marketing leading offering in RD Tax Credits Grant Writing services over a number of years. RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount.

R D Tax Credit Calculation Examples Mpa

The credit benefits large and small companies in virtually every industry yet our research shows many businesses are leaving money on the table.

. Its calculated on the basis of increases in research activities and expendituresand as a result its intended to reward companies that pursue innovation with increasing investment. Company X made profits of 400000 for the year calculate the RD tax credit saving. Total number of employees in your business.

Multiply that average by 50. 100000 130 130000. Subtract the result of Step 2 from the companys current year QREs.

RD Tax Credits Calculator. Select either an SME or Large company. 10000 x 130 enhancement rate 13000.

It was increased to. RD Tax Credit Calculator Finsights F. 100000 x 130 130000 uplift 400000 130000 270000 revised profit 270 000 x 19 51300 Corporation Tax 76 000 51300 24700 Corporation Tax saving 24700 approx.

Select whether the company is profitable or loss making. Insights FInsights gives you industry leading white papers details of some of our projects and the latest news in RD. So if your RD spend last year was 100000 you could get a 25000 reduction in your tax bill.

Example 1 is optimal because the pre RD loss is greater than the qualifying costs. The rate of relief is 25. Enhanced RD qualifying spend or uplift.

Corporation Tax CT before RD tax credit claim is 76000. 23000 x 145 RD surrender rate 3335. Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend.

According to the latest available figures UK companies claimed a total of 74 billion in the year ending March 2020 through the RD tax credit scheme. RD Tax Credits are a very niche part of the UK tax code that could bring your company thousands of pounds in tax relief. Guidance on this can be found on our Which RD scheme is right for my company page.

13000 x 19 corporation tax rate 2470. Just follow the simple steps below. Our RD Tax Credits Calculator will give you a ball-park figure on how much RD Tax Relief you could receive from HMRC.

Average calculated RD claim is 56000. One of the hard issues to understand about RD Tax Credits is that the pre RD tax position influences the amount of the payable tax credit. 10000 x 230 enhancement rate 23000.

Calculate how much RD tax relief your business could claim back. If youre a loss-making business youll receive your RD tax credit in cash because you dont have a tax liability to offset. This can be done for the current financial year and the 2 previous years.

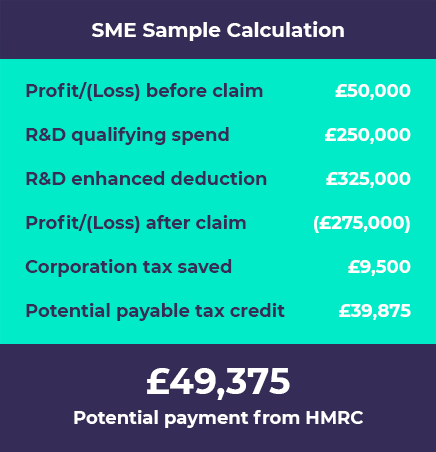

Sample calculations for RD tax relief claims. RD Tax Credit Consultant. The RDEC is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017.

12 from 1 January 2018 to 31 March 2020. RD Tax Credit Calculation. Use our simple calculator to see if you qualify for the RD tax credit and if so by how much.

Loss-making SME with 10000 RD spend. RD Tax Credit is 212500 1453081250 CT600 boxes 530875 Losses to carry forward are zero. Corporation Tax before RD tax credit claim.

Profit-making SME with 10000 RD spend. The qualifying expenditure is 100000 thats already in accounts as expenditure. The RRC is an incremental credit that equals 20 of a taxpayers current-year QREs that exceed a base amount which is determined by applying the taxpayers historical percentage of gross receipts spent on QREs the fixed-base percentage to.

First however the fix-based percentage must be obtained by dividing the QREs for tax years during a base period by the gross receipts from the same period. 35000 - 45000 DoE Monthly Performance Bonus Scheme. Before you can calculate the amount you receive in RD tax credit carryforward youll need to ensure that your business is located in the US and pays tax.

Complete the form below to find out how much you could claim. Free RD Tax Calculator. Then youll need to have the following figures on hand.

If the company spent 100000 on RD projects in a year then its potential RD Credit would be 9700. The RD tax credit is for taxpayers that design develop or improve products processes techniques formulas or software. The RD Tax Credit Calculator is best viewed in Chrome or Firefox.

The rate of relief is up to 33. 25 saving from RD tax credits. Calculate the credit by multiplying the result of Step 3 by 14.

The credit is calculated at 13 of your companys qualifying RD expenditure this rate applies to expenditure incurred on or after 1 April 2020 and is. Surrender of losses in return for payable tax credit up to 33 of qualifying expenditure For accounting periods beginning on or after 1 April 2021 the payable RD tax credit that a loss-making SME can receive will be capped at 20000 plus three times the amount paid in respect of PAYE and Class 1 NIC liabilities. Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief.

Figure the companys average qualified research expenses QREs for the past three years. SMEs can claim an RD tax credit through the SME RD tax incentive to SME RD relief allows companies to deduct an extra 130 of their qualifying costs from their yearly profit as well as the standard 100 deduction to make a total of 230 deduction and claim a tax credit if the company is loss-making worth up to 145 of the surrenderable loss.

R D Tax Credits The Essential Guide 2020

R D Tax Credit Rates For Rdec Scheme Forrestbrown

R D Tax Credit Rates For Sme Scheme Forrestbrown

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Examples Mpa